Welcome to Your Secure Tax Document Portal

Follow the steps below to upload your documents or connect with our team. Your data is 100% encrypted and IRS-compliant.

🔒 SSL Secured | IRS-Authorized E-File Provider

🏆 [X] Years of Trusted Service | 5-Star Rated on Google

👤 Individual Tax Filing

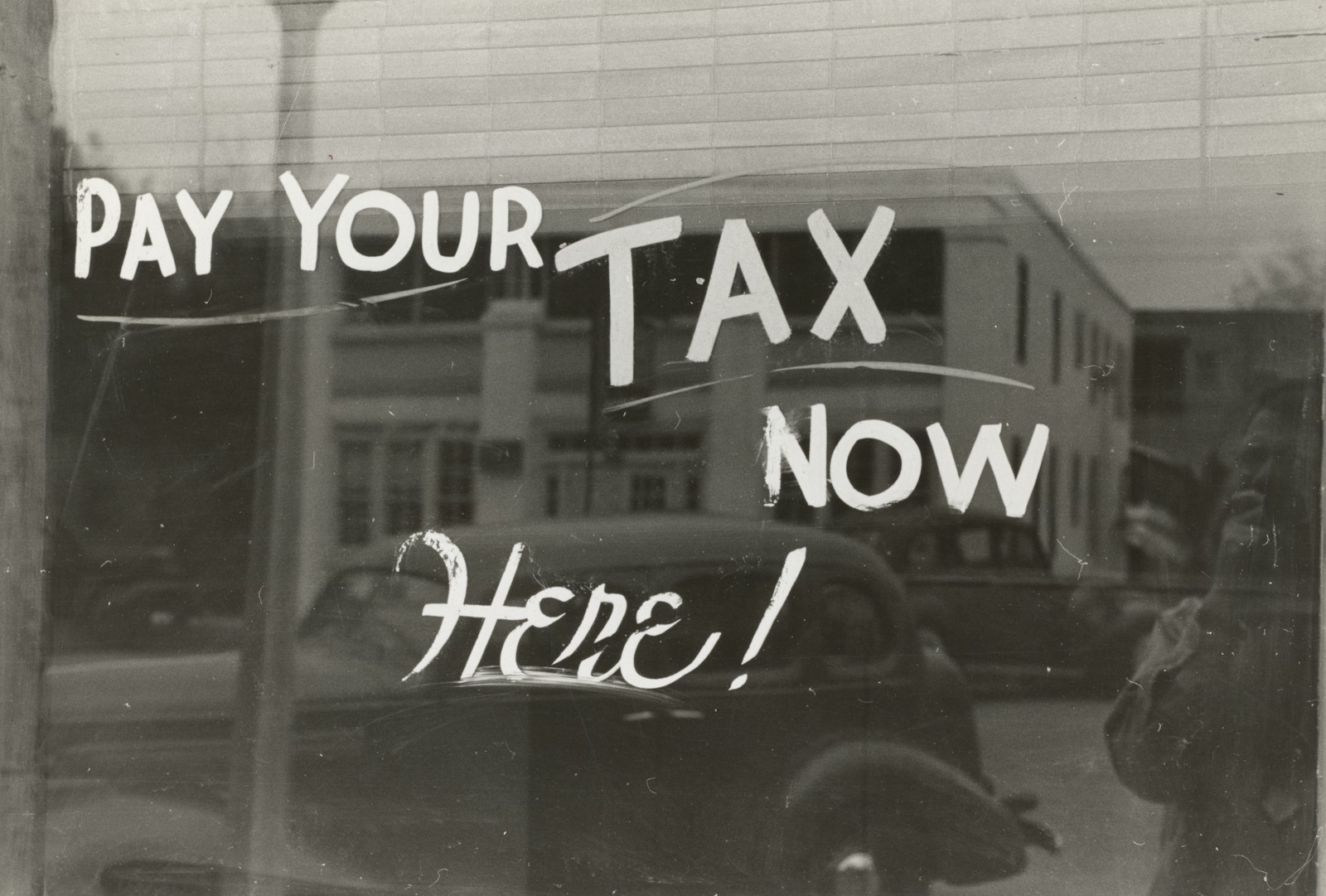

Individual Filers: Upload Your Documents Here

What You’ll Need:

- W-2s, 1099s, and income statements

- Deduction receipts (charity, medical, etc.)

- Last year’s tax return (if available)

Note: “Self-employed? Use the Business Portal entity form”

🏢 Business Entity Filing

Business Filers: Upload LLC, S-Corp, or Partnership Docs

What You’ll Need:

- Profit & Loss Statements, 1099-MISC/NEC

- K-1s, payroll records, expense receipts

- Business asset details (if applicable)

☎️ Need Help? Talk to Us!

Unsure where to start? We’ll guide you!

📞 Phone: (561) 715 8181 (Mon-Sat, 9 AM–6 PM)

What Happens After You Upload?

- 🔐 Step 1: We review your documents within 24 hours.

- 📝 Step 2: We prepare your return and email you a draft.

- ✅ Step 3: You approve, and we e-file instantly.

✅ All files are encrypted with bank-level security.

✅ We comply with IRS Publication 4557 for data protection.

FAQ

Document Portal FAQs

Is there a fee to upload documents?

No! Uploading is free. You’ll only pay once we finalize your return.

What file types do you accept?

PDF, JPEG, PNG, Excel or scanned documents.

Can I edit my upload later?

es! Email us at brian@acgdept.com with updates.